Tuesday, August 12, 2014

Thursday, June 19, 2014

Learnings

Day one

1. Always use market orders. What we are doing is trading in a very short term trend. The only way to do it successfully is if the trend has already started and we are expecting continuation. Limit orders are perfect when we are expecting a reversal, as we are expecting the price to move in an opposite direction and then follow the desired direction. Market orders are perfect when we expect continuation of trend.2. EMA(14) over 2 minute chart is the new stop loss and trade indicator.

3. Don't get emotionally involved with the trade. Don't expect the trade to reverse after you take a position or second position.

4. Reduce trading size to 20,000.

5. Trade option price of around 100 and target 5 points. Do multiple trades if required. If the market trends then increase the target. Do not increase stop loss.

6. Put stop loss.

Day two

1. Trade when there is no movement.

2. Always note the position of highs and lows before you trade.\

3. Trade by Invested amount, not lot size.

4. Try to buy when the stock is at low and sell when the stock is at high.

5. No trading in first and last 15 minutes.

6. Trade with the trend. If higher lows and higher highs are being made, then buy at low. Sell when a high of the same level is made.

7. Expect to capture one-third of the movement.

Thursday, June 12, 2014

Good trade turns bad

Following Business Plan 4,I went short the minute the market opened on Wednesday. The market went up immediately hitting my stop loss. I reversed direction immediately, and waited for the market to rise up by 33%. Everything went perfectly as planned till now. Now came the problem. I did not follow the EMA(14) sell signal when the market fell below the line after a long time. The market unfortunately did not rise back up and kept falling till it hit my stop loss. I ended up loosing 11000 on 40000. A very bad day. At least found the importance of EMA(14) line.

Another horrible day. Target was not reached. Made many losses. Brain fried. Trade on diversion from EMA(14). Will trade on 20,000. from tomorrow. Don't need more money. Target 1000 per day. Strict stop loss reversals tomorrow.

Another horrible day. Target was not reached. Made many losses. Brain fried. Trade on diversion from EMA(14). Will trade on 20,000. from tomorrow. Don't need more money. Target 1000 per day. Strict stop loss reversals tomorrow.

Tuesday, June 10, 2014

Amadeus Trading - Business Plan 3 & 4

The details for Business Plan 3 are given below:

Invested amount - INR 40,000

Vehicle - NIFTY ATM Options

Split up - 6-10 lots of price 50-150 each

Time - 1 day

1 month - 100% with Probability of profit as 75%

1 day - 10%

Reentry - Next day

Stop Loss - 10% or 1 day

Cool off period - Same day. Only 1 trade per day

Max profit - 100% over a month

Max reduction - 88% of portfolio

Test period - June-July

Trade Idea - Follow Slow Stochastic on this chart. Add SSTO(14,3) and EMA(14).

The details for Business Plan 4 are given below:

Invested amount - INR 40,000

Vehicle - NIFTY ATM Options

Split up - 6-10 lots of price 50-150 each

Time - less than a day

1 month - 200%

1 day - 15 points

Reentry - Immediate

Trailing Stop Loss - 5 point

Stop Loss - 10 points

Cool off period - Same day. Only 1 trade per day

Max profit - 200% over a month

Max reduction - 10 trades to reach 0.

Test period - June-July

Trade Idea - Follow Slow Stochastic on this chart. Add SSTO(14,3) and EMA(14).

Have a trailing stop loss of 5 points when target is reached.Reverse on hitting stop loss. Don't trade if stop loss is hit multiple times. Wait for breakout and then enter in direction of breakout.

Invested amount - INR 40,000

Vehicle - NIFTY ATM Options

Split up - 6-10 lots of price 50-150 each

Time - 1 day

1 month - 100% with Probability of profit as 75%

1 day - 10%

Reentry - Next day

Stop Loss - 10% or 1 day

Cool off period - Same day. Only 1 trade per day

Max profit - 100% over a month

Max reduction - 88% of portfolio

Test period - June-July

Trade Idea - Follow Slow Stochastic on this chart. Add SSTO(14,3) and EMA(14).

The details for Business Plan 4 are given below:

Invested amount - INR 40,000

Vehicle - NIFTY ATM Options

Split up - 6-10 lots of price 50-150 each

Time - less than a day

1 month - 200%

1 day - 15 points

Reentry - Immediate

Trailing Stop Loss - 5 point

Stop Loss - 10 points

Cool off period - Same day. Only 1 trade per day

Max profit - 200% over a month

Max reduction - 10 trades to reach 0.

Test period - June-July

Trade Idea - Follow Slow Stochastic on this chart. Add SSTO(14,3) and EMA(14).

Have a trailing stop loss of 5 points when target is reached.Reverse on hitting stop loss. Don't trade if stop loss is hit multiple times. Wait for breakout and then enter in direction of breakout.

Thursday, May 29, 2014

Cost basis reduction

The original value of an asset is called as its cost basis. The act of reducing the amount paid for the asset is called as Cost basis reduction. The stock prices are assumed to move randomly when no new information is added to the market. The assumption is that stock prices will move in a log normal fashion around the current market price. If this holds, then the stock price would have a lower probability of touching the outer extremes. The is can be used to our advantage to reduce the cost basis.

The cost basis can be reduced using mainly three techniques - Naked put, Covered call and covered call combined with a purchase of a further out of the money call, or as I like to call it, Covered call spread. All three have different advantages and risks. It is important to understand the scenario to choose which techniques to choose from.

Naked put

This involves a sale of an out of the money put option, with the hope that the stock will not fall below the option strike. The premium collected goes towards the cost basis reduction.

This involves a purchase of the underlying and sale of an out of the money call option, with the hope that the stock will not rise above the option strike. The idea is that we are capping our profits to reduce our cost basis. The premium collected goes towards the cost basis reduction.

This involves a purchase of the underlying and sale of an out of the money bearish call spread, with the hope that the stock will not rise above the option strike of the sold call. The idea is that we are capping our profits to reduce our cost basis and protecting ourselves against any large upward movement. Although the safest of the three, it also gives the least return.

The cost basis can be reduced using mainly three techniques - Naked put, Covered call and covered call combined with a purchase of a further out of the money call, or as I like to call it, Covered call spread. All three have different advantages and risks. It is important to understand the scenario to choose which techniques to choose from.

Naked put

This involves a sale of an out of the money put option, with the hope that the stock will not fall below the option strike. The premium collected goes towards the cost basis reduction.

- When to buy - We have enough cash to buy 1 or more lot of the underlying. But we would prefer to reduce our cost basis.

- Choosing the underlying - As we expect the stock to not move below a price, we should choose an underlying which has formed a support and does not expect bad news in the future

- Choosing the put - We should choose a strike below the support level, or one standard deviation below the current market price.

- Calculating return - Return is calculated as premium collected upon cash kept aside to buy the stock.

- Booking profit - The position is held till expiry.

- Managing loss - If at all the stock price touches the support level, it can either mean the stock is cheap in which case, we buy back the put at a loss and buy the stock. A further out of the money put can also be sold to collect more premium and cover our losses. Or it can mean the stock is not worth buying. In which case an out of the money call can be sold.

Covered call

This involves a purchase of the underlying and sale of an out of the money call option, with the hope that the stock will not rise above the option strike. The idea is that we are capping our profits to reduce our cost basis. The premium collected goes towards the cost basis reduction.

- When to buy - We either already hold the stock or would like to buy the stock as we are bullish on the stock, but don't know when the stock would rise. Also we have enough cash to buy 1 or more lot of the underlying and enough to hold for margin.

- Choosing the underlying - As we expect the stock to not move above a price, we should choose an underlying which has good fundamentals and are quite sure of stock not falling down.

- Choosing the put - We should choose a strike above the resistance level, or one standard deviation above the current market price.

- Calculating return - Return is calculated as premium collected upon cash invested in the underlying and the margin kept aside.

- Booking profit - The position is held till expiry.

- Managing loss - If at all the stock price touches the option strike, it means the stock is moving well. Best idea is to book a loss on the call option and sell an out of the money put to cover the loss. Another way to deal with it is to convert the position to Covered call spread and finance it with a out of the money put.

Covered call spread

This involves a purchase of the underlying and sale of an out of the money bearish call spread, with the hope that the stock will not rise above the option strike of the sold call. The idea is that we are capping our profits to reduce our cost basis and protecting ourselves against any large upward movement. Although the safest of the three, it also gives the least return.

- When to buy - We either already hold the stock or would like to buy the stock as we are bullish on the stock, but don't know when the stock would rise. Also we have enough cash to buy 1 or more lot of the underlying and enough to hold for margin.

- Choosing the underlying - As we expect the stock to not move above a price, we should choose an underlying which has good fundamentals and are quite sure of stock not falling down.

- Choosing the put - We should choose a strike above the resistance level, or one standard deviation above the current market price.

- Calculating return - Return is calculated as premium collected upon cash invested in the underlying and the margin kept aside.

- Booking profit - The position is held till expiry.

- Managing loss - If at all the stock price touches the option strike, it means the stock is moving well. Best idea is to sell an out of the money put to further extend the profit.

Sunday, May 11, 2014

Vertical Spreads

As defined by investopedia.com, An options trading strategy with which a trader makes a simultaneous purchase and sale of two options of the same type that have the same expiration dates but different strike prices is called as Vertical spread.

To define in a simpler way, a vertical spread consists of two trades, one buy and one sell of with both either put or call. As both are opposite there is either a net debit or credit. Hence they are also called credit or debit spreads. And depending on whether the option is put or call, the names for the vertical spread are

Google Drive Link -->

To define in a simpler way, a vertical spread consists of two trades, one buy and one sell of with both either put or call. As both are opposite there is either a net debit or credit. Hence they are also called credit or debit spreads. And depending on whether the option is put or call, the names for the vertical spread are

- Credit put spread - A lower put is purchased and a higher put is sold. Typically has a higher probability of success and higher risk. This position is bullish.

- Credit call spread - A lower call is purchased and a higher call is sold. Typically has a higher probability of success and higher risk. This position is bearish.

- Debit put spread - A higher put is purchased and a lower put is sold. Typically has a lower probability of success and lower risk. This position is bearish.

- Debit call spread - A higher call is purchased and a lower call is sold. Typically has a lower probability of success and lower risk. This position is bullish.

Google Drive Link -->

Saturday, May 10, 2014

Kelly Criterion - I

The Kelly criterion is a formula used to derive the optimal size of a bet in a series of bets.In some investing scenarios, with some assumptions the formula will do better than any strategy in the long run.

The Kelly criterion says that amount of bet should be same as the ratio of expectation and gain per unit bet. To illustrate, say there is a 60% chance that an investment goes up by 5% and 40% chance that it goes down by 3%. Then,

The Kelly criterion says that amount of bet should be same as the ratio of expectation and gain per unit bet. To illustrate, say there is a 60% chance that an investment goes up by 5% and 40% chance that it goes down by 3%. Then,

f = Expectation per unit bet / Gain per unit bet

f = (0.6 * 0.05 - 0.4 * 0.03) / 0.05

f = 0.36

That is, we must bet thirty six hundredth of our portfolio to maximize our success. Any bet below is too conservative and any bet above is too aggressive.It is a recommended that the bet actually be only half of the Kelly fraction to avoid incorrect probability and give room for higher losses. Kelly criterion works well only for defined risk trades like vertical spreads, and will not work well for undefined risk trades.

Wednesday, May 7, 2014

Volatilities - II

Implied Volatility is used to determine the expected move of the underlying. IV as a metric represents a 1 standard deviation expected move in the underlying for the next year. We can also estimate expected moves for various time frames using this formula

1SD Move = Price * IV * sqrt(DTE/365)

where DTE is Days to expiration

Positions as on 7-May-2014

Covered call on TCS:

Long Stock 125 at 2181.25 - 21652300 Call written for 30 - 25

Profit = 625

Strangle on NIFTY:

7300 Call written for 104 - 44.056500 Put written for 109 - 161.3

Profit = 382.5

Bullish Naked Call:

6800 Call bought for 214 - 182Profit = -3200

Net profit = -2193

Tuesday, May 6, 2014

Volatilities

There is historical volatility and implied volatility. One is an input to the option pricing module, the other is an output of the model. Together they create 4 scenarios

| Historical Volatility | Implied Volatility | Trend |

|---|---|---|

| Low | Low | Sideways |

| Low | High | Expect a big move |

| High | Low | Consolidate |

| High | High | Trend Continues |

Friday, May 2, 2014

Naked put

A naked put consists of a single trade, writing a deeply out of the money put with the intention of buying the stock at the strike value of the put. If the stock stays above the strike, the put expires worthless and the profit is equal to the value of the put. If the stock falls below the strike, then the loss is the difference between the share and the strike price less the the premium collected. But on the other side the stock can now be purchased at the put strike price less the premium.

To take an example, 150 Put for BHEL(179.5) is written at 1.7. At a lot of 2000 the total value is 3400 at a margin of 42000. If the stock remains above 150, the return is roughly 8%. If it falls below, then we can purchase the stock at a 30 Rs discount as against buying it at 179.5. If the stock crashes further, it is better to buy the put back at a loss. Suggest trading to reduce the losses at this point.

Google drive link -->

To take an example, 150 Put for BHEL(179.5) is written at 1.7. At a lot of 2000 the total value is 3400 at a margin of 42000. If the stock remains above 150, the return is roughly 8%. If it falls below, then we can purchase the stock at a 30 Rs discount as against buying it at 179.5. If the stock crashes further, it is better to buy the put back at a loss. Suggest trading to reduce the losses at this point.

Google drive link -->

Positions as on 2-May-2014

Covered call on TCS:

Long Stock 125 at 2181.25 - 22092300 Call written for 30 - 40

Profit = 2218.75

Strangle on NIFTY:

7300 Call written for 104 - 56.36500 Put written for 109 - 154.25

Profit = 122.5

Bullish Naked Call:

6800 Call bought for 214 - 211Profit = -150

Net profit = 2191.25

Wednesday, April 30, 2014

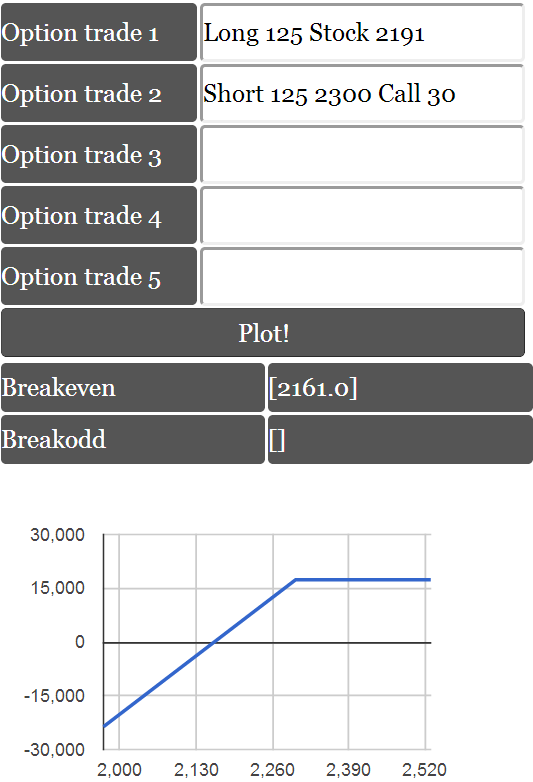

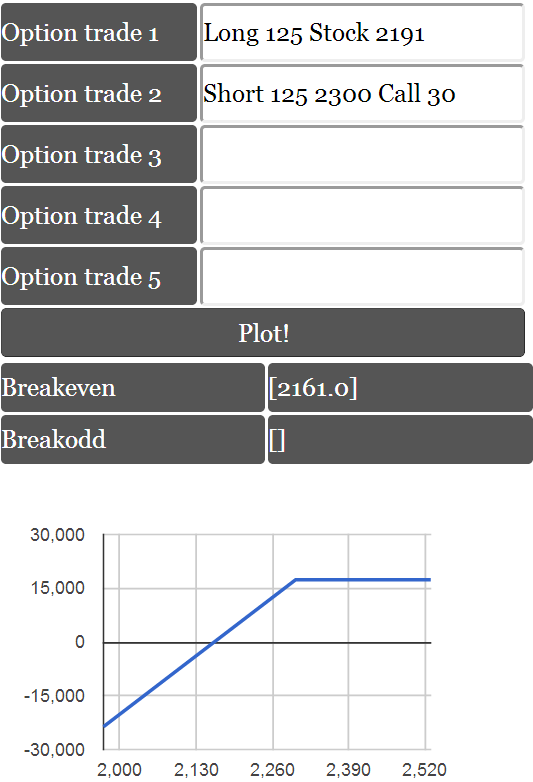

Covered Call

A covered call consists of two trades, first a purchase of stocks and second selling an out of the money call for a marginal profit. The break even gets reduced by the written call's value. The maximum profit gets capped at the sum of written call's strike and its value. The profit above the written strike's value is sacrificed. The strategy under performs above the maximum profit value.

To take an example, TCS is purchased at the current market price of 2191. The break even for the shares alone would be 2191. On selling a 2300 call for 30, the break even is now 2161 and the max profit is capped at 2330. Over 2330, the strategy under performs.

To take an example, TCS is purchased at the current market price of 2191. The break even for the shares alone would be 2191. On selling a 2300 call for 30, the break even is now 2161 and the max profit is capped at 2330. Over 2330, the strategy under performs.

Sample trade:

TCS

Lot Size = 125

Share price = 2191

Share Value = 273875

2300 CALL = 30

Margin to write CALL = 39520.81

Amount received on writing the CALL = 3750

Break even = 2191 - 30 = 2161

Max profit = 2300 + 30 = 2330

Total invested amount = 313395.81

Profit (==2191) = 3750 / 313395.81 = 1.19%

Max profit (>=2300)= 17375 / 313395.81 = 5.54%

Annualized profit range = 15.34% - 91.07%

Google Drive Link -->

To take an example, TCS is purchased at the current market price of 2191. The break even for the shares alone would be 2191. On selling a 2300 call for 30, the break even is now 2161 and the max profit is capped at 2330. Over 2330, the strategy under performs.

To take an example, TCS is purchased at the current market price of 2191. The break even for the shares alone would be 2191. On selling a 2300 call for 30, the break even is now 2161 and the max profit is capped at 2330. Over 2330, the strategy under performs.Sample trade:

TCS

Lot Size = 125

Share price = 2191

Share Value = 273875

2300 CALL = 30

Margin to write CALL = 39520.81

Amount received on writing the CALL = 3750

Break even = 2191 - 30 = 2161

Max profit = 2300 + 30 = 2330

Total invested amount = 313395.81

Profit (==2191) = 3750 / 313395.81 = 1.19%

Max profit (>=2300)= 17375 / 313395.81 = 5.54%

Annualized profit range = 15.34% - 91.07%

Google Drive Link -->

Tuesday, April 29, 2014

TCS & SUNPHARMA

TCS formed a support on 2000, then 2100 and gave the first white candle after 5 days of black candles yesterday. Since 18th the stock has hardly moved. I bet that the stock will move upwards.

Sunpharma made a black doji on top of a big white candle. It should fall today. Expecting a black candle.

Sunpharma made a black doji on top of a big white candle. It should fall today. Expecting a black candle.

INDIAVIX and Natenberg - Update

The 7300 Call was sold at 104 and 6500 Put was sold for 109, for a total of 214. The break even points are 6286 and 7514. A range of 1228.

The prices today are 54 for the Call and 125 for the Put. That is a sum of 179, a profit of 35.

To continue the trade, the plan is to buy back the call at 50, for a profit of 54 and sell the 7100 call for 102.

Now 109 + 102 is 211 and the booked profit of 54 added gives a margin of 264 on both sides.The break even points now are 6236 and 7364. A range of 1100.

The prices today are 54 for the Call and 125 for the Put. That is a sum of 179, a profit of 35.

To continue the trade, the plan is to buy back the call at 50, for a profit of 54 and sell the 7100 call for 102.

Now 109 + 102 is 211 and the booked profit of 54 added gives a margin of 264 on both sides.The break even points now are 6236 and 7364. A range of 1100.

Tuesday, April 22, 2014

INDIAVIX and Natenberg

INDIAVIX closed at 33.35 on 21 April 2014. The implied volatility for 6800 call was at 31.51 when the NIFTY is at 6815. Natenberg would say to sell option outside the money. I expect the volatility to drop to 20. The trade is

SELL 7300 CALL @ 103

SELL 7300 CALL @ 103

SELL 6400 PUT @ 105

NIFTY can move between 6200 and 7500 without a loss.

NIFTY can move between 6200 and 7500 without a loss.

Tuesday, March 11, 2014

Amadeus Trading - Business Plan 2

The details for Business Plan 2 are given below:

Invested amount - INR 500,000

Vehicle - Stocks

Split up - 10 investments of 50,000 each

Time -

1 month - 7%

15 days - 4%

1 day - 2%

Reentry - Stocks can be reentered at levels below the first buy price

Stop Loss - 5% or 1 month

Cool off period - 15 days since the beginning of last trade

Max profit - 100% over a year

Max reduction - 30% of portfolio

Trade Sample 1:

Invested amount - INR 500,000

Vehicle - Stocks

Split up - 10 investments of 50,000 each

Time -

1 month - 7%

15 days - 4%

1 day - 2%

Reentry - Stocks can be reentered at levels below the first buy price

Stop Loss - 5% or 1 month

Cool off period - 15 days since the beginning of last trade

Max profit - 100% over a year

Max reduction - 30% of portfolio

Trade Sample 1:

Trade this pattern with options. Enter on fourth candle of support.

Friday, February 21, 2014

Paper Trades - Positions

-----Bought on 14-Feb-2014----------

Sell SUNPHARMA 630 Call @ 6.05 for 500 lot size, IV is 28.66

Currently @ 2.50

Book profit for 1775

Sell HCLTECH 1440 Put @ 9.35 for 250 lot size, IV is 29.32

Currently @ 1.1

Book profit for 2062.5

-----Bought on 18-Feb-2014----------

Sell 1 lot of Nifty 5800 MAR PUT @ 26.30 for 1315

Currently @ 21.65

Sell 1 lot of Nifty 6400 MAR CALL @ 18.75 for 937.5

Currently @ 13.15

Total profit is 3837.5

Sell SUNPHARMA 630 Call @ 6.05 for 500 lot size, IV is 28.66

Currently @ 2.50

Book profit for 1775

Sell HCLTECH 1440 Put @ 9.35 for 250 lot size, IV is 29.32

Currently @ 1.1

Book profit for 2062.5

-----Bought on 18-Feb-2014----------

Sell 1 lot of Nifty 5800 MAR PUT @ 26.30 for 1315

Currently @ 21.65

Sell 1 lot of Nifty 6400 MAR CALL @ 18.75 for 937.5

Currently @ 13.15

Total profit is 3837.5

Thursday, February 20, 2014

Paper Trade - Positions

-----Bought on 14-Feb-2014----------

Sell SUNPHARMA 630 Call @ 6.05 for 500 lot size, IV is 28.66

Currently @ 4.75

Sell TATAMOTORS 380 Put @ 4.25 for 1000 lot size, IV is 31.04

Currently @ 2.0

Book profit for 2250

Sell HCLTECH 1440 Put @ 9.35 for 250 lot size, IV is 29.32

Currently @ 7.25

-----Bought on 18-Feb-2014----------

Sell 1 lot of Nifty 5800 MAR PUT @ 26.30 for 1315

Currently @ 21.75

Sell 1 lot of Nifty 6400 MAR CALL @ 18.75 for 937.5

Currently @ 17.3

Sell 1 lot of BHARTIARTL 320 FEB CALL @ 2.3 for 2300

Currently @ 0.5

Book profit for 1800

Sell 1 lot of IDEA 140 FEB CALL @ 0.9 for 1800

Currently @ 0.5

Book profit for 800

Total profit is 4850

Sell SUNPHARMA 630 Call @ 6.05 for 500 lot size, IV is 28.66

Currently @ 4.75

Sell TATAMOTORS 380 Put @ 4.25 for 1000 lot size, IV is 31.04

Currently @ 2.0

Book profit for 2250

Sell HCLTECH 1440 Put @ 9.35 for 250 lot size, IV is 29.32

Currently @ 7.25

-----Bought on 18-Feb-2014----------

Sell 1 lot of Nifty 5800 MAR PUT @ 26.30 for 1315

Currently @ 21.75

Sell 1 lot of Nifty 6400 MAR CALL @ 18.75 for 937.5

Currently @ 17.3

Sell 1 lot of BHARTIARTL 320 FEB CALL @ 2.3 for 2300

Currently @ 0.5

Book profit for 1800

Sell 1 lot of IDEA 140 FEB CALL @ 0.9 for 1800

Currently @ 0.5

Book profit for 800

Total profit is 4850

Wednesday, February 19, 2014

Paper Trade - Positions

-----Bought on 14-Feb-2014----------

Sell SUNPHARMA 630 Call @ 6.05 for 500 lot size, IV is 28.66

Currently @ 7.25

Sell TATAMOTORS 380 Put @ 4.25 for 1000 lot size, IV is 31.04

Currently @ 2.4

Sell HCLTECH 1440 Put @ 9.35 for 250 lot size, IV is 29.32

Currently @ 5.25

-----Bought on 18-Feb-2014----------

Sell 1 lot of Nifty 5800 MAR PUT @ 26.30 for 1315

Currently @ 16.5

Sell 1 lot of Nifty 6400 MAR CALL @ 18.75 for 937.5

Currently @ 28

Sell 1 lot of BHARTIARTL 320 FEB CALL @ 2.3 for 2300

Currently @ 1.3

Sell 1 lot of IDEA 140 FEB CALL @ 0.9 for 1800

Currently @ 1.15

Sell SUNPHARMA 630 Call @ 6.05 for 500 lot size, IV is 28.66

Currently @ 7.25

Sell TATAMOTORS 380 Put @ 4.25 for 1000 lot size, IV is 31.04

Currently @ 2.4

Sell HCLTECH 1440 Put @ 9.35 for 250 lot size, IV is 29.32

Currently @ 5.25

-----Bought on 18-Feb-2014----------

Sell 1 lot of Nifty 5800 MAR PUT @ 26.30 for 1315

Currently @ 16.5

Sell 1 lot of Nifty 6400 MAR CALL @ 18.75 for 937.5

Currently @ 28

Sell 1 lot of BHARTIARTL 320 FEB CALL @ 2.3 for 2300

Currently @ 1.3

Sell 1 lot of IDEA 140 FEB CALL @ 0.9 for 1800

Currently @ 1.15

Tuesday, February 18, 2014

Amadeus Trading - Business Plan

The goal of Amadeus trading is to earn theta gain by writing out of the money options.The net invested captial is to be INR 250,000 completely funded by me. The execution will be carried out by an entity henceforth called trader. The trade ideas will be created by me, henceforth called Analyst.

There will be two ideas alive at any moment. Each will have a maximum margin requirement of 65,000. 120,000 will be used to cover when the trades go bad. Losses will be covered aggressively by buying in the money options. The target return for 130,000 invested will be 40%. So each trade should earn 1,200 in a period of 15 days.

The job of analyst is to come up with support or resistance levels with enough margin so that the option can be written for one month. The analyst will have complete control over the trade to be executed when the market is closed. Every ten days two new ideas will created. The following points will encompass an idea:

It is yet to be decide when the losses should be covered. This will need to be taken into account during execution.

There will be two ideas alive at any moment. Each will have a maximum margin requirement of 65,000. 120,000 will be used to cover when the trades go bad. Losses will be covered aggressively by buying in the money options. The target return for 130,000 invested will be 40%. So each trade should earn 1,200 in a period of 15 days.

The job of analyst is to come up with support or resistance levels with enough margin so that the option can be written for one month. The analyst will have complete control over the trade to be executed when the market is closed. Every ten days two new ideas will created. The following points will encompass an idea:

- Stock name

- Stock price

- Support level

- Resistance level

- Proposed trade

- Implied volatility

- Historical volatility percentile rank

- Option distance from stock price in terms of standard deviation

- Comments

It is yet to be decide when the losses should be covered. This will need to be taken into account during execution.

Paper Trades - Positions

-----Bought on 14-Feb-2014----------

Sell SUNPHARMA 630 Call @ 6.05 for 500 lot size, IV is 28.66

Currently @ 3.4

Sell TATAMOTORS 380 Put @ 4.25 for 1000 lot size, IV is 31.04

Currently @ 2.7

Sell HCLTECH 1440 Put @ 9.35 for 250 lot size, IV is 29.32

Currently @ 8.9

-----Bought on 18-Feb-2014----------

Sell 1 lot of Nifty 5800 MAR PUT @ 26.30 for 1315

Currently @ 21.5

Sell 1 lot of Nifty 6400 MAR CALL @ 18.75 for 937.5

Currently @ 23.1

Sell 1 lot of BHARTIARTL 320 FEB CALL @ 2.3 for 2300

Currently @ 1.6

Sell 1 lot of IDEA 140 FEB CALL @ 0.9 for 1800

Currently @ 0.9

Sell SUNPHARMA 630 Call @ 6.05 for 500 lot size, IV is 28.66

Currently @ 3.4

Sell TATAMOTORS 380 Put @ 4.25 for 1000 lot size, IV is 31.04

Currently @ 2.7

Sell HCLTECH 1440 Put @ 9.35 for 250 lot size, IV is 29.32

Currently @ 8.9

-----Bought on 18-Feb-2014----------

Sell 1 lot of Nifty 5800 MAR PUT @ 26.30 for 1315

Currently @ 21.5

Sell 1 lot of Nifty 6400 MAR CALL @ 18.75 for 937.5

Currently @ 23.1

Sell 1 lot of BHARTIARTL 320 FEB CALL @ 2.3 for 2300

Currently @ 1.6

Sell 1 lot of IDEA 140 FEB CALL @ 0.9 for 1800

Currently @ 0.9

Monday, February 17, 2014

Paper Trades

Sell 1 lot of Nifty 5800 MAR PUT @ 26.30 for 1315

Sell 1 lot of IDEA 140 FEB CALL @ 0.9 for 1800

Sell 1 lot of Nifty 6400 MAR CALL @ 18.75 for 937.5

Sell 1 lot of BHARTIARTL 320 FEB CALL @ 2.3 for 2300Sell 1 lot of IDEA 140 FEB CALL @ 0.9 for 1800

Paper Trade - Positions

Hold Short SUNPHARMA 630 Call @ 4.2 for 500 lot size, IV is 31

Price is 605, Gain is 925

Hold Short TATAMOTORS 380 Put @ 4.4 for 1000 lot size, IV is 31.61

Price is 386.60, Gain is -150

Hold Sold HCLTECH 1440 Put @ 7.8 for 250 lot size, IV is 32.83

Price is 1503.6, Gain is 387.5

Price is 605, Gain is 925

Hold Short TATAMOTORS 380 Put @ 4.4 for 1000 lot size, IV is 31.61

Price is 386.60, Gain is -150

Hold Sold HCLTECH 1440 Put @ 7.8 for 250 lot size, IV is 32.83

Price is 1503.6, Gain is 387.5

Paper Trades

Sell SUNPHARMA 630 Call @ 6.05 for 500 lot size, IV is 28.66

Price is 610.8

Sell TATAMOTORS 380 Put @ 4.25 for 1000 lot size, IV is 31.04

Price is 389.65

Sell HCLTECH 1440 Put @ 9.35 for 250 lot size, IV is 29.32

Price is 1497.7

Price is 610.8

Sell TATAMOTORS 380 Put @ 4.25 for 1000 lot size, IV is 31.04

Price is 389.65

Sell HCLTECH 1440 Put @ 9.35 for 250 lot size, IV is 29.32

Price is 1497.7

Subscribe to:

Posts (Atom)